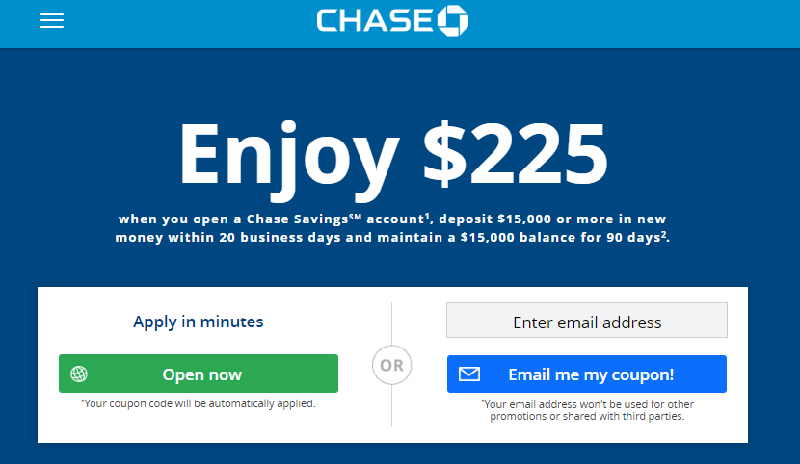

Chase Bank is currently offering qualified residents nationwide a $225 bonus when you sign up and open a new Chase SavingsSM account by August 6, 2018. If you are interested in this generous offer, all you would have to do is apply online or request a coupon and head over to your local branch. To get started, simply deposit $15,000 or more in new money within 20 business days of account opening and maintain that balance for 90 days. Once you have done so, you will have access to the generous bonus as well as a host of account features! If you are interested in the offer, I recommend you hurry on in today or apply online and be a part of one of the nation’s longest running and largest financial institution!

Chase Bank is currently offering qualified residents nationwide a $225 bonus when you sign up and open a new Chase SavingsSM account by August 6, 2018. If you are interested in this generous offer, all you would have to do is apply online or request a coupon and head over to your local branch. To get started, simply deposit $15,000 or more in new money within 20 business days of account opening and maintain that balance for 90 days. Once you have done so, you will have access to the generous bonus as well as a host of account features! If you are interested in the offer, I recommend you hurry on in today or apply online and be a part of one of the nation’s longest running and largest financial institution!

Chase SavingsSM Summary:

- Apply Now

- Account Type: Savings Account

- Maximum Bonus: $300

- Availability: Nationwide (Bank Locator)

- Expiration Date: 08/06/2018

- Soft/Hard Pull: Soft Pull

- Credit Card Funding: Yes, up to $500

- Direct Deposit Requirement: No

- Additional Requirements: Listed below

- Avoid Monthly Fee: $5, see below on how to avoid

- Early Termination Fee: If the savings account is closed by the customer or Chase within six months after opening, they will deduct the bonus amount at closing

Chase Bonus Requirements:

- Open a new Chase SavingsSM account, which is subject to approval

- Deposit a total of $15,000 or more in new money within 20 business days of account opening

- Maintain at least a $15,000 balance for 90 days from the date of deposit

- After you have completed all the above requirements, Chase will deposit the bonus in your new account within 10 business days

Chase SavingsSM Account Features:

- Access to over 16,000 Chase ATMs and 5,100 branches

- Mobile check deposit – It’s as easy as taking a selfie.

- Link this account to your Chase checking account for Overdraft Protection

- Access Chase QuickPay® – Take the drama out of splitting a check.

- Real-time fraud monitoring – We watch your debit-card to help your money stay your money.

Chase Bonus Fine Print:

- Bonus not available to those whose accounts have been closed within 90 days or closed with a negative balance.

- The new money cannot be funds held by Chase or its affiliates.

- Only one bonus per account.

- The bonus is considered interest and will be reported on IRS Form 1099-INT(or Form 1042-S, if applicable).

How to Avoid The Fees:

Avoid $5 fee for Chase SavingsSM by completing at least one of the following:

- Keep a minimum daily balance of $300 or more in your savings account

- Have at least one repeating automatic transfer from your Chase checking account of $25 or more

- Are under 18 years of age

- Have a linked Chase Premier Plus Checking, Chase Premier Platinum Checking, or Chase Private Client CheckingSM account

Chase Bank Review Conclusion:

At the end of the day, the current promotion from Chase Bank is a great option for those who would like to start a new banking experience. Not only do you get to enjoy the generous bonus that comes with your new account, but you will also have the confidence and security of knowing you are receiving the best service and care the bank has to offer. If you are interested, I would personally recommend signing up simply because the requirements can be easily met. If you have extra fund and would like to earn more, you can check out Chase Coupon $300 Savings Bonus review instead. I would definitely recommend this promotion if you have the funds available. Feel free to comment below on this Chase Bank Review article to tell us about your banking experience with Chase!

Connect with me