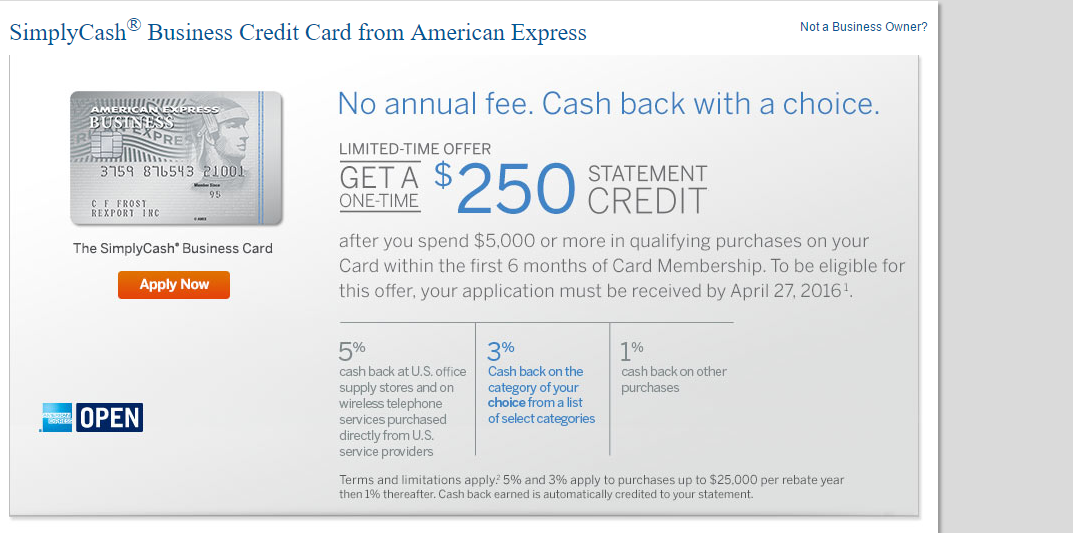

Sign up for the SimplyCash Business Credit Card from American Express and you can earn a $250 Statement Credit when you make $5,000 in purchases within the first six months of account opening, valid until January 25, 2016. Spend more, get back more, you get 5% cash back at U.S. office supply stores and on wireless telephone services purchased directly from U.S. service providers, 3% cash back on a category of your choice from a list of select categories, and 1% cash back on other purchases. The 5% and 3% rebates apply to purchases up to $25,000 per rebate year, then 1% thereafter. With this card, you can accumulate some serious cash back for your business. This card offers high rewarding attractive and serious cash back, but if you’re a business sole proprietary that doesn’t yield the necessary expenses then this card may not be worth it for you. But if you’re interested, then I suggest you keep reading on!

Sign up for the SimplyCash Business Credit Card from American Express and you can earn a $250 Statement Credit when you make $5,000 in purchases within the first six months of account opening, valid until January 25, 2016. Spend more, get back more, you get 5% cash back at U.S. office supply stores and on wireless telephone services purchased directly from U.S. service providers, 3% cash back on a category of your choice from a list of select categories, and 1% cash back on other purchases. The 5% and 3% rebates apply to purchases up to $25,000 per rebate year, then 1% thereafter. With this card, you can accumulate some serious cash back for your business. This card offers high rewarding attractive and serious cash back, but if you’re a business sole proprietary that doesn’t yield the necessary expenses then this card may not be worth it for you. But if you’re interested, then I suggest you keep reading on!

Key Features:

- Limited Time Offer: Earn a one-time $250 statement credit after you spend $5,000 or more in qualifying purchases on your Card within the first 6 months of Card Membership

- To be eligible for this offer, your application must be received by January 25, 2016

- With no annual membership fee, it’s a smart choice for your business

- 5% cash back at U.S. office supply stores and on wireless telephone services purchased directly from U.S. service providers

- 3% cash back on the category of your choice from a list of select categories and 1% cash back on other purchases

- 5% and 3% apply to purchases up to $25,000 per rebate year then 1% thereafter. Cash back earned is automatically credited to your statement

Pros:

- You can earn a $250 Statement Credit when you make $5,000 in purchases within the first six months of account opening

- Attractive Sign-up bonus

- Attractive Annual fee of $0

- Flexibility, Simplicity, and Choice

- Receipt Match with QuickBook

- OPEN Savings (online portal functions like the bonus malls many issuers offer with business owners)

- OPEN Forum (concierge that will provide you assistance on your business)

- Good for Small business owners who spend a lot on office supplies and wireless phone service

- Good for Small business owners who want to be able to choose where they’ll earn bonus cash back

- Good for Small business owners who want the ability to roll a balance from month to month

Cons:

- Limits on Cash back

- Preset on Spending limit

- Short Promotional Period

- Not recommended for people who don’t travel a lot

- Short zero introductory APR

- Not recommended if the person’s business doesn’t have high enough expenses to compensate for annual fee

Final Analysis:

Sign up for the SimplyCash Business Credit Card from American Express before April 27,2016 and receive a $250 Credit Statement! This card offers a great amount of cash back and flexibility for a Business card. If you are a business owner that spends a lot on office supplies, wireless phone service, or want to be able to choose where you can earn cash back, this card is for you. You can earn 5% back on purchases up to $25,000, then 1% on purchases. There is no annual fee either, but this card isn’t recommended if your a business owner who travels a lot. This card won’t be worth it for you if your expenses don’t meet the necessary spending threshold in the business categories. so if you’re not interested in this card at the moment, I recommend checking out our complete list of Credit Card Promotions for all of your credit card requisites!

Connect with me