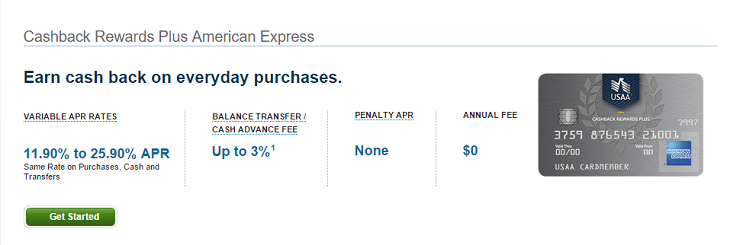

Register for a USAA Cashback Rewards Plus American Express Card and you can earn up to 5% Cash Back when you make an annual purchase of $3000 or more with selected purchases in gasoline and military base purchases. Similarly, you’ll earn 2% cashback on groceries after your first $3,000 in annual purchases. You’ll also get 1% cashback on all other purchases with no limit! On top of that, there is no annual fees, and no penalty APR! This is a outstanding military cash-back credit card, with very rewarding and generous cash back rates.

Register for a USAA Cashback Rewards Plus American Express Card and you can earn up to 5% Cash Back when you make an annual purchase of $3000 or more with selected purchases in gasoline and military base purchases. Similarly, you’ll earn 2% cashback on groceries after your first $3,000 in annual purchases. You’ll also get 1% cashback on all other purchases with no limit! On top of that, there is no annual fees, and no penalty APR! This is a outstanding military cash-back credit card, with very rewarding and generous cash back rates.

Key Features

- Earn 5% cashback on gasoline and military base purchases after spending at least $3000 in annual purchases

- No Annual Fee

- Earn 2% cashback on groceries after spending at least $3000 in annual purchases

- Earn 1% back on all other purchases with no limit

- Security, travel, and retail benefits

- Special benefits for military

- Security and convenience

- Travel and Protection Benefits

- Emergency roadside assistance

- Car rental loss and damage Insurance

- Concierge serviceTravel accident insurance

- Identity theft recovery unit

Pros:

- No Annual Fee

- Easy to earn points

- Military Deployment Benefits (Servicemembers Civil Relief Act)

- Chip Technology for additional protection

- Rewarding cash-back benefits

- Annual Cash rebates

- Mileage Waiver

- Travel Benefits

- Travel Accident Insurance can cover travel by plane, train, ship, or bus when you purchase the entire fare on your eligible Card.

- And Much Much More

Cons:

- Foreign Transaction fee (low of 1%)

- Card needs excellent credit score

- Cannot obtain if you’re not a military servicemen, or government worker.

Final Analysis:

Receive your USAA Cashback Rewards Plus American Express Card today and start getting %5 cash back on your purchases! This card is ideal for anyone trying to save big and receive an optimal cash back ratio. With special benefits for all military personal, I recommend this card for any veteran that is interested in the perks of saving money. This card offers a generous cash back if you frequently spending on base or on gasoline if you’re in the military. This card is primarily for Military servicemen, government officials and their family members. If you’re a past or active member of the military, these credit cards generally provide superior perks and benefits than you’ll be able to find elsewhere. If you don’t fit the categories mentioned, then make sure to also check out our complete list of Credit Card Deals for all of your credit card needs!

Connect with me